Unveil the Ultimate Cashflow Planning Strategy:

A systematic approach to massive diversification ensuring 100% capital protection & effective risk management under regulatory guidelines

Shield yourselves from the most daunting challenges & risks of Over Diversification, Over Churning, Outdated Investment Options , Hidden Risks, Liquidity Risks, Fear Of Loss So On & So Forth.

₹4500/- now For Only₹1200/-

Mamta Sinha Sharma

Principal Wealth Coach

17 + yrs Exp

How Does It Work? Watch Short Video.

Get an " EXCLUSIVE INSIGHT " into " THE SYSTEMATIC WEALTH MULTIPLICATION STRATEGY "- A Combined Portfolio Ownership managed by Top 3 Industry Leaders across focused sectors , leaving no stones unturned.

₹4500/- now For Only₹1200/-

A whole new vision to create multi- Billionaire Indians

₹4500/- now For FREE

The 'ELA SELECT CIRCLE' Card - Your Gateway To A Host Of Rare & Exclusive Privileges.

Why debt mutual funds are ideal for emergency funds

Secure and accessible, debt mutual funds are ideal for emergency funds. With stability, liquidity, and diversification, they offer a reliable and balanced solution. Shielded from market volatility, these funds provide quick access to funds without lock-in periods, ensuring peace of mind during crises.

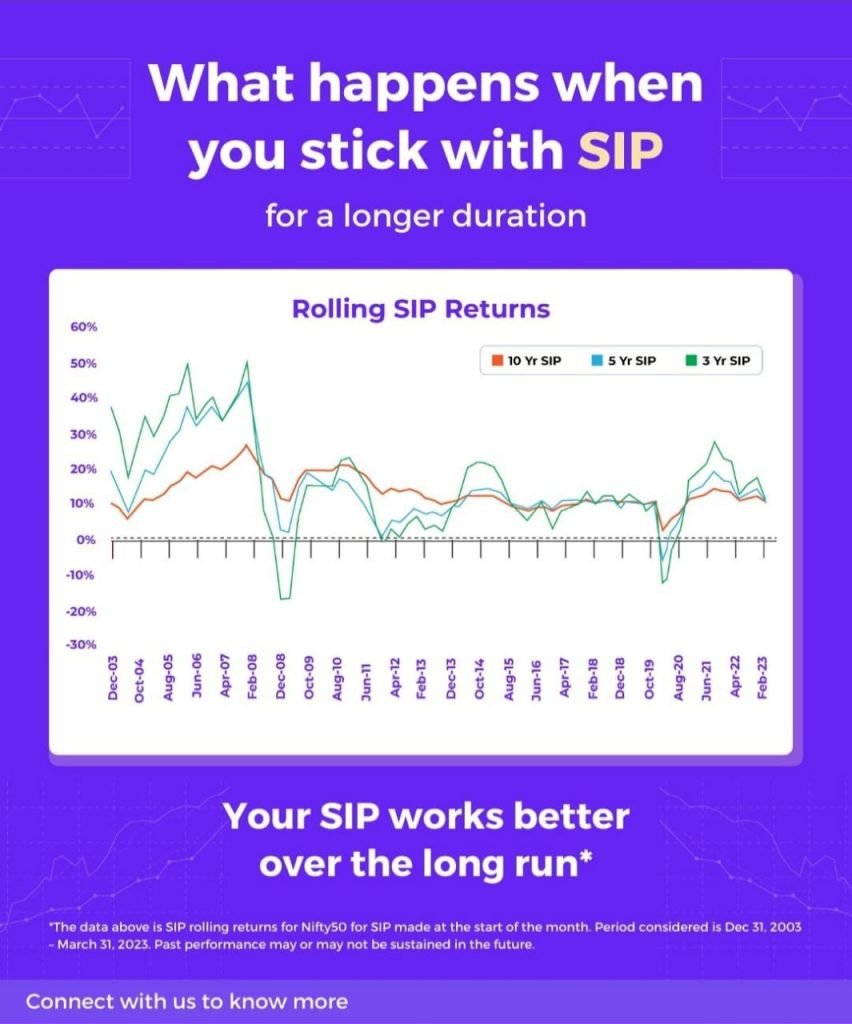

What happens when s you stick with SIP

Sticking with a Systematic Investment Plan (SIP) can yield impressive results over time. By consistently investing a fixed amount at regular intervals, you benefit from the power of compounding. Over the long term, this disciplined approach helps to smooth out market fluctuations and build wealth. Moreover, SIPs instill financial discipline, encouraging regular savings and minimizing the impact of emotional decision-making.

Types of mutual funds and their features

Mutual funds come in various types, each with distinct features. Equity funds offer growth potential through investments in stocks. Debt funds focus on fixed-income securities, providing stability and regular income. Balanced funds offer a mix of equity and debt. Index funds replicate market indices, while thematic funds focus on specific sectors.

How investing through SIP is a convenient investment option

Investing through Systematic Investment Plan (SIP) offers convenience as an investment option. With SIP, you can invest a fixed amount regularly, aligning with your budget. It eliminates the need for timing the market and allows you to benefit from rupee-cost averaging. SIPs provide flexibility, ease of automation, and make investing hassle for long-term wealth creation.

SPA Vouchers

Pamper Yourself With 100% Redeemable Spa Vouchers At The Finest Of 5 Star Hotels & Resorts In Your City & Other Locations With Your ELA SELECT CIRCLE Card.

The World Is Now Your Oyster!

Fine Dining

Your ELA SELECT CIRCLE Card Pampers You With The Most Amazing Gastronomic Experiences Through Complimentary Dining Vouchers At The Finest Restaurants Across Various Cities In The Country!

Cruise Expeditions

Revel In The Sun-Swept Experience Of Your 100% Complimentary Luxury Cruise Trips - Both Within & Outside The Country!

₹4500/- now For Only₹1200/-

Why is a Highly Profitable Diversified Portfolio a right fit for you

- Build a Wealth Multiplication Portfolio with “Zero Loss”& " Zero complex technical jargons"

- No Distraction by all the 4000 + schemes, funds or investment industry vehicles

- While you stay focused on your personal/ professional/ Business Growth, we manage all your wealth creation goals with zero stress

- Reviewing & Rebalancing of Portfolio after every 3 years is very important for generating optimum results & protect the return too.

- Dedicated services & a Wealth Coach with straight-talking, no-frills awareness & industry updates & flawless paperless execution

- Stay informed on various Assets’ performance history, future growth, measurement areas, right entry & exit points

- Special Solutions for small business owners functional since minimum 3 years, helping them get unlimited Tax Benefits under Income Tax Act, 1961 generate high returns/ liquidity & be in the Govt good books too.

Mamta Sinha Sharma

Principal Wealth Coach

📢 Unlock the Secrets to Wealth Multiplication with Your Dedicated Wealth Coach! 🏦💰

Hi there! I'm Mamta Sinha Sharma, your trusted Wealth Coach, here to guide you on a transformative journey towards financial success. With over two decades of experience in the Banking, Financial Advisory, and Wealth Management space, I have assisted countless investors – individuals, entrepreneurs, and business owners – in achieving their financial goals effortlessly. Together, we can build a unique portfolio that reflects your status and focuses on sectors that matter to you.

Introducing the Wealth Multiplication Platform, where I share the invaluable knowledge gained from industry exposure and practice, addressing the personal finance issues faced by many Indians due to a lack of awareness.

While Indians are renowned as one of the world's highest savers, a significant portion of these savings remains locked in fixed deposits with banks. But with inflation ranging between 7% and 10%, can a fixed deposit truly create wealth for you?

Furthermore, recent surveys reveal a decline in the saving rate among Indians. This is primarily attributed to societal changes such as increased avenues for spending, the rise of nuclear families, and the impact of inflation. Even with the savings amassed, people are hesitant to explore options beyond fixed deposits. Unfortunately, this approach can lead to an insufficient retirement corpus since there is no growth asset in the portfolio.

Additionally, with the overwhelming speed and volume of information available today, it becomes challenging to filter through the risks of over diversification, over churning, outdated investment options, hidden risks, liquidity risks, and the fear of loss, among others.

But fear not! You now have the opportunity to unleash your skills in filtering information and creating a carefully selected pool of reliable sources that align with your investing preferences.

Our advisory platform focuses on Systematic Wealth Multiplication through a massive diversification structure, guided by regulatory guidelines to ensure 100% capital protection and risk management. Your portfolio will be expertly managed by the top three industry leaders – Max, ICICI, and SBI – while I, your dedicated Wealth Coach, will provide continuous support and service.

Take control and design your own portfolio according to your unique status and requirements, following a simplified, balanced exposure approach that incorporates both equity and debt assets.

Curious about what your diversified portfolio could look like? Picture 3-4 actively managed schemes strategically tailored to meet your short- and long-term financial goals, all reviewed every three years to ensure optimal performance.

Please note that the participation amount may vary between 5,000 and 50 Crore INR, based on your eligibility and underwriting approvals.

Attention, business owners! Prepare to unlock unlimited benefits on corporate tax for an infinite time period, accompanied by substantial wealth appreciation and liquidity. To redefine your wealth and status, don't hesitate to schedule a consulting call with your dedicated Wealth Coach today!

📞 Schedule Your Call Now and Unleash Your Wealth Potential! 🌟💼

Team

Dr(HC*) Rishi S. Patela

Associate Director

He is known as Brainstormer RSP. He has been one of the Top 100 influential Indians Award Winner. Angel Investor, Guinness World Record participant and also a member of London world record

Ms. Preeti Gupta

AVP- KS Wealth Coach

Ms. Sumati Arya

Chief Technology Officer

- KS Wealth Coach

₹4500/- now For Only₹1200/-

Delighted KS Wealth Coach family speaks !!

S.K. Aggarwal

Mamta Sinha Sharma at KS Wealth Coach has been an invaluable source of information since a decade & helped me a great deal to understand the world of Wealth Mgmt..

Punam Gupta

Mamta@ kswealthcoach is highly professional & has deep knowledge about the wealth mgmt sector.. would definitely recommend

Vanita Kapur

Since more than a decade Mamta has been selflessly acting as my angel Wealth Coach, extremely helpful , knowledgeable & professional

Answers To Key Questions

Yes, you can earn a steady monthly pension immediately & reinvest just 20% of it towards actively managed equity funds to generate superlative high compounding returns to become a multi-Millionaire much before your retirement age.

Yes almost 90% of your portfolio will be Open- ended, hence liquidity won’t be a concern anytime, anywhere

Yes you can defer unlimited Corporate Tax Liability for infinite period & generate huge unbelievable cash flow simultaneously

KS Wealth Coach works as your dedicated manager & shall design, review, manage, optimize & protect the profits using our expertise of 2 decades.

We Provide end to end Tax solutions to your- TDS/GST Return, ITR- Return/ Tax Audit & Accounting. Our existing clients gets reimbursement of upto 50%** on mandatory fee applicable on the services above

What's in for Small Business Owners

KS Wealth Coach specializes in empowering small business owners and entrepreneurs with effective Cashflow Planning Strategies. We assist clients in transforming business expenses into substantial cashflow, all while safeguarding their savings. With a focus on risk-free financial management, KS Wealth Coach aims to help entrepreneurs, business owners and small industries to build a lasting financial legacy through prudent and strategic wealth-building practices.

₹4500/- now For Only₹1200/-

A whole new vision to create multi- Billionaire Indians

Address:

Property No. 44, Above Madame Tussauds, Regal Building, Connaught Place, New Delhi- 110001

Mailbox:

Phone:

GSTIN

07BCFPS0295D1ZM

UAM

DL03D0013680